The Uneven Impact of Global Events

When a global disruption strikes — tariffs, supply chain delays, or currency swings — the impact doesn’t fall evenly. Large corporations have buffers: diversified markets, access to credit, and specialized risk teams. Small and medium enterprises (SMEs), however, often feel the tremors first and hardest.

These businesses operate with lean margins, tight cash cycles, and limited reserves. For many founders, a sudden disruption isn’t just an inconvenience; it’s a question of survival.

The Fragility of SME Cash Flow

Unlike multinationals, SMEs usually don’t have the luxury of excess liquidity. A two-week shipping delay can freeze working capital. A currency depreciation can erode export margins overnight. Without structured planning, these ripple effects become existential threats.

Trusted accounting firms and Virtual CFO support are stepping in to close this gap — offering real-time monitoring and financial modeling that help SMEs predict and withstand volatility.

According to Harvard Business Review, global shocks often expose supply chain weaknesses that smaller firms struggle to absorb.”

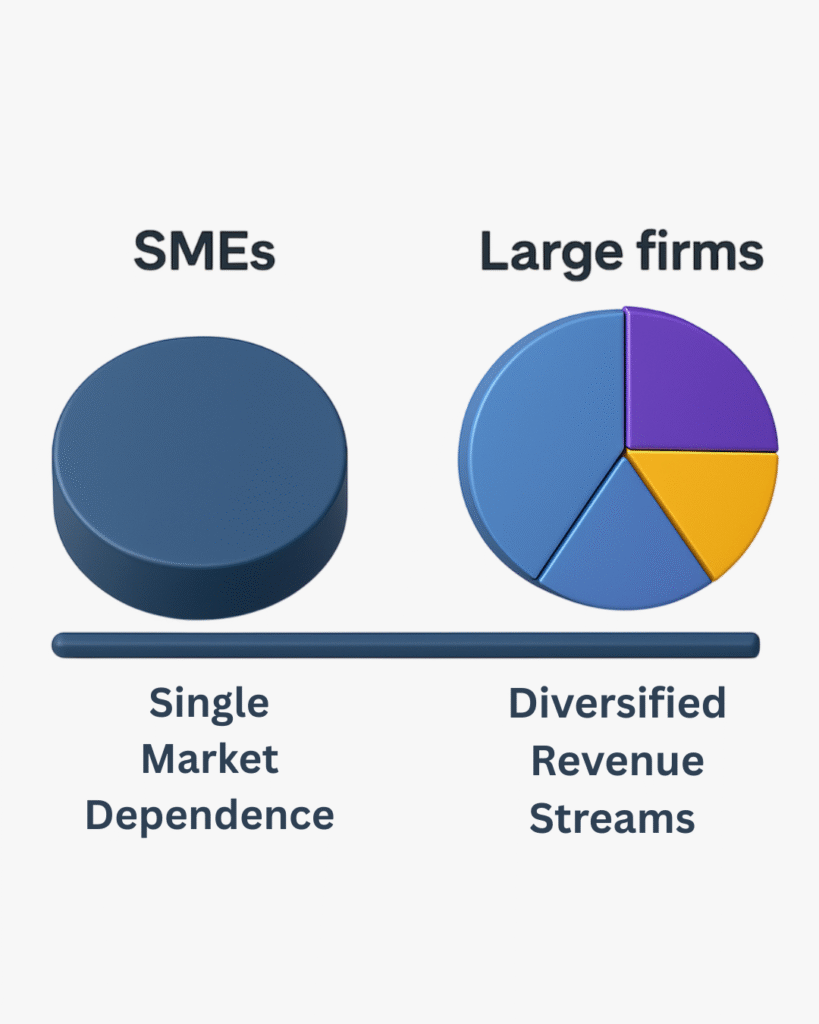

Why Scale Creates Safety

Large organizations spread risk across geographies and suppliers. SMEs, by contrast, are often tied to one market or vendor. This reliance magnifies shocks. For example:

- A single tariff increase on raw materials can reduce already thin margins.

- Currency volatility makes loan repayments unpredictable.

- Overdependence on one export destination leaves revenues hostage to foreign policy shifts.

Strategic financial planning — supported by experienced advisors — enables SMEs to diversify revenue channels, adjust pricing models, and build contingency funds.

Building Buffers: From Reaction to Preparation

Resilient SMEs don’t wait for shocks to happen; they prepare for them. The most effective steps include:

These approaches are no longer optional; they’re becoming the difference between survival and growth.

The Strategic Role of Advisory Partners

For SMEs, having access to structured financial expertise is not about luxury — it’s about resilience. Leading firms across India, including specialized Virtual CFO services, are helping businesses move from reactive firefighting to proactive strategy.

It’s this professional support — not size alone — that enables smaller enterprises to compete with larger players during global volatility.

Conclusion

Global shocks will always be a feature of modern business. But the way SMEs respond determines whether they remain vulnerable or emerge stronger.

With the right financial guidance, even the smallest enterprise can turn uncertainty into opportunity — not by avoiding volatility, but by being prepared for it.

Explore how our Virtual CFO Services can help SMEs build resilience against global uncertainties